Source: Canva.com

Introduction

The lithium-silicon battery is a subset of lithium-ion battery technology that employs a silicon-based anode and lithium ions as the charge carriers. Even micro and nanoparticles incorporated onto the surface of the graphite anodes can result in a significant change in the capacity of the graphite-based negative electrode.

The replacement (not a 100% replacement) of carbon/graphite anodes with silicon anodes will result in significantly higher storage and longer battery life, as replacing graphite with silicon in the anode increases the energy density. The below diagram explains the same.

However, the emergence of silicon anodes leaves manufacturers in a dilemma because silicon expands and contracts and the battery's cycle life tends to be limited. The product is also expensive to manufacture.

Lithium-ion batteries play a major role in enriching our lives, from laptops to cellphones, from grid storage to electric cars. Moreover, the prevalence of the EV sector and its reliance on batteries is expected to trigger the growth of the market in the forthcoming years.

In addition, when a lithium-ion battery charges, lithium ions flow to the anode, which is typically made of graphite, a type of carbon. When graphite is replaced with silicon, far more lithium ions can be stored in the anode, increasing the battery's energy capacity. However, packing all of these lithium ions into the electrode causes it to swell like a balloon, growing up to four times larger in some cases.

Nonetheless, Silicon is a difficult anode material to work with because it expands up to 400% volumetrically upon full lithium insertion while shrinking upon lithium extraction. Huge stresses are placed on the anode during charge/discharge cycles due to the significant expansion and contraction in electrodes with high percentages of Silicon, resulting in mechanical fracture of the electrodes. As a result, pure Silicon anodes are impractical, and only 3 to 10% Silicon is typically added to the anode of a graphite-dominant battery to maintain good cycle life.

Why industries should shift to Lithium-Silicon Batteries?

Even if silicon-incorporated batteries/cells perform significantly well, the fact that they can hamper the batteries’ life cannot be ignored. But if strategically solved, silicon-based chemistries can be the future of energy storage possibilities.

What’s more? Higher energy density, holding more charge than graphite anode batteries, significantly faster charging, and considerably more stability than graphite batteries.

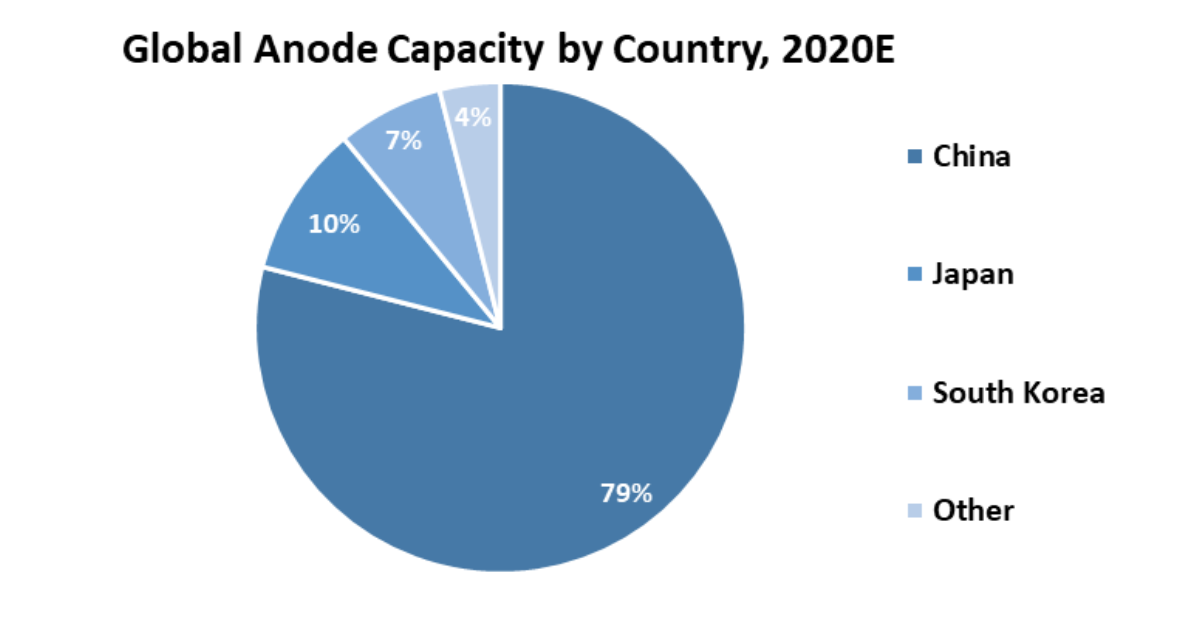

Another reason can be the constrained supply of graphite. China and Japan have dominated the world's natural graphite production to date. Control of graphite abroad means that the US and other countries will be challenged to ensure the affordability of Li-ion batteries while also ensuring that natural graphite supplies do not run out.

In other words, the world’s natural graphite supply is incapable of meeting the tidal wave of electrified demand in an efficient, cost-effective, and, most importantly, reliable manner.

In response to the natural graphite supply crunch, investments in synthetic graphite production have been made, a solution that cannot meet the looming demand.

To ensure that consumer electronics, mobility technologies, electric vehicles, and aerospace reach their full potential and spread beyond the next ten years, we must move away from graphite, a geographically controlled resource.

However, low-cost graphite electrodes with an energy density of ~372mAh/g have long been the first choice in Lithium batteries. Nonetheless, as manufacturers seek

- higher energy densities

- alloying materials with good thermodynamic lithiation potential,

- increased average voltage

- higher gravimetric

- volumetric energy capacities

Such qualities of Silicon could be critical to higher capacity batteries. Silicon offers a theoretical specific capacity of up to 4,200 mAh/g, which is approximately ten times greater than conventional graphite anodes.

In addition, silicon is relatively environmentally friendly, non-toxic, and found in abundance in the Earth’s crust. Also, the manufacturers can easily find inexpensive and reasonably priced silicon without any threats.

Investment Overview

According to RationalStat Analysis, a sixfold jump has been witnessed in investments in EV battery technologies rowing from US$ 1.5 billion in 2020 to US$ 9.4 billion in 2021 as automobile manufacturers step up their efforts to electrify the global fleet.

Furthermore, cumulative funding for silicon anode start-ups reached $1.9 billion in 2021, with the global Silicon battery market expected to grow at a CAGR of 36.2% from US$ 38 million in 2020 to US$ 177 million by 2025.

- Porsche

-

- Not only this, the German luxury high-performance car brand, Porsche announced its investment of US$ 100 million in a series C funding of Group14 technologies, which is a US-based company working on the R&D of lithium-silicon technologies. With this investment, the company aims at producing high-performance battery cells for motorsport and vehicles with the master capability.

- Ingevity

-

- Ingevity, a chemical and materials company, invested US$ 60 million in a US$ 170 million round earlier this month to acquire an equity stake in Nexeon Limited, as part of a strategic move to establish the company's presence in the electric vehicle (EV) market and expand opportunities to grow its activated carbon business.

- Sila nanotechnologies

-

- Sila Nanotechnologies received US$ 45 million from the Canada Pension Plan Investment Board in exchange for equity. Sila intends to use the new funds to increase production. It intends to begin supplying its silicon nanocomposite anode material to manufacturers of consumer electronics batteries next year.

- POSCO

-

- POSCO, based in South Korea, paid US$ 47.8 billion for the acquisition of silicon anode startup Tera Technos, as the steelmaker plans to expand its position in the Li-ion battery supply chain and further plans to invest US$ 20 billion in the lithium-ion supply chain.

What are companies across the globe contributing?

Whilst research continues into cathodes such as Lithium-Nickel-Cobalt-Aluminum Oxide, Lithium-Nickel-Manganese-Cobalt (NMC), and Lithium Iron-Phosphate (LFP) continues, several companies are focusing on the anode to improve energy density and performance.

A change in the anode materials, specifically from graphite to Silicon (Si) or Lithium-metal (LiM), is of particular interest for providing a stepwise improvement in energy density.

In addition, to overcome the limitations of using silicon with lithium, manufacturers are exploring a wide range of solutions, including methods of increasing electrode porosity, electrolyte additives, and conductive and binding materials.

"First and foremost, we're pushing for higher energy density," - CEO Gene Berdichevsky, Sila Nanotechnologies

Moreover, companies like GDI are expected to use a unique design of 100% silicon anode, which gives advanced Li-ion batteries 30% higher energy density and allows them to reach 75% charge in 15 minutes.

Future of Lithium-Silicon Batteries

Although silicon-incorporated batteries are the future of batteries, there are numerous opportunities for chemistry and materials innovation to improve Li-ion battery components. Moreover, the future of the EV sector is bright, which will contribute to the growth of the demand for more environment-friendly options.

In the next ten years, the reality of a Li-ion battery capable of delivering lower costs, faster charging, higher cyclability, and safety while being made from abundant raw materials found all over the world and recycled is within reach. As the world transitions from a fossil-fuel-based economy to an entirely solar and wind-powered one, demand for such a battery would reach unprecedented levels, reaching as high as 30,000 GWh annually by mid-century.

To speak to our industry consultant for a discussion, Speak to the Analyst

Divyanshu Sharma

Co-founder and Director at RationalStat

Divyanshu is an experienced market research consultant. He helps growth-driven organizations and entrepreneurs understand market entry prospects, industry assessment, and grow their revenue strategically.